Did you know that there are certain rights that every employer is obligated to uphold for the employees? Unfortunately, most employees do not even know about their rights. Also, even highly educated employees do not understand the employment law, making it challenging for them whenever they face problems in their work process. This is why it is important for you as an employee to consult with an employment law firm near you.

An employment law firm provides employees and employers with legal assistance whenever they face legal issues related to their places of work. Also, your employment law firm can provide you with support and guidance on matters regarding your employment. A good percentage of employers consult with employment law firms, but very few employees ever talk to employment lawyers until they face serious legal issues. If you are an employee wondering whether you should consult with an employment law firm, the following section will provide several reasons why this is important.

Why Employees Need To Consult With An Employment Law Firm

You may not understand their importance in employees’ lives if you have never consulted with an employment law firm. The following are some of the reasons why you should consult with the lawyers in the employment law firm of your choice;

- Employment lawyers have adequate knowledge of the employment laws

So many laws govern the workplace, and they’re always changing every day while others are being developed daily. Unfortunately, only professionals in employment law understand this kind of law and are always updated with every change and development in employment law. For this reason, when you consult with their employment lawyers, they will help you understand your rights, responsibilities and obligations as an employee. Also, if you face work problems, they will help you know the best action to take. Therefore, you should consult with a law firm because it provides lawyers with an adequate understanding and knowledge of the employment law that most employees lack.

- Get legal representation

Another reason you should consult with an employment law firm is that they can offer you legal representation whenever necessary. If you have to appear in court, you can always count on the employment lawyers in your law firm to provide you with representation on your behalf. In addition, they also help you when filing a lawsuit and even negotiate on your behalf in case you need to be compensated for anything. The legal representation your employment law firm offers is important, especially if the situation you face at work is either sensitive or complex.

- Access to legal advice

Consulting with employment law at Prosper Law makes sure that you have access to professional and unbiased advice on different issues that are work-related. For this reason, whenever you want to make a work-related decision, you can always rely on the advice your employment law firm offers so that you can make informed decisions.

- Protect your interest

Unlike your employer, your employment law firm has your best interests at heart. Therefore we always ensure they do all we can to protect your interests. This includes reviewing your contracts or agreements before your employer sends them and negotiating better employment terms. Also, even when you do not understand your rights, your employment law firm will ensure they are protected.

- Saves you money

When you consult with an employment law firm, you pay a certain fee for their services. I love you. Having them ensures that you do not make costly mistakes and increases your chances of having a fair outcome during a lawsuit. All this helps you save a substantial amount of money and like when you do not consult with an employment law firm.

If you have always believed that only employers need employment law firms, you know why having them is important. For this reason, start looking for a reliable employment law firm you can consult whenever necessary. Avoid waiting until you find yourself in trouble so that you can hire an employment law firm.

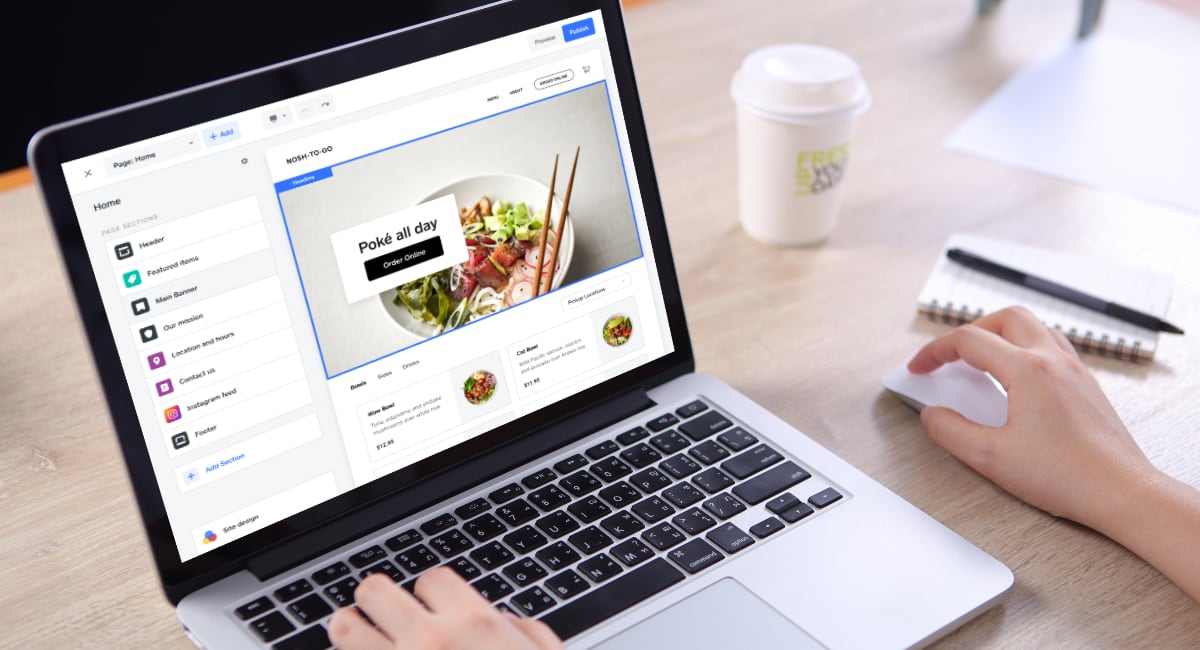

This is the best time for beginning an on-line save. This is due to the fact that increasingly more people are purchasing on-line, which is hassle-free, quickly as well as time conserving experience. This is among the major reasons that many offline companies that don’t have ecommerce internet sites are swiftly shedding clients. Put simply, on-line purchasing is terrific for both the consumers as well as local business owner.

This is the best time for beginning an on-line save. This is due to the fact that increasingly more people are purchasing on-line, which is hassle-free, quickly as well as time conserving experience. This is among the major reasons that many offline companies that don’t have ecommerce internet sites are swiftly shedding clients. Put simply, on-line purchasing is terrific for both the consumers as well as local business owner. Many individuals that have accessibility to the Web realize that they can gain good loan via the Web. Possibly you as soon as had actually ideas to beginning your e-business: pick a domain name, discover a holding, download and install free on-line keep design theme and also begin to offer the products from a close-by keep. And also beginning waiting up till customers ring and also get products.

Many individuals that have accessibility to the Web realize that they can gain good loan via the Web. Possibly you as soon as had actually ideas to beginning your e-business: pick a domain name, discover a holding, download and install free on-line keep design theme and also begin to offer the products from a close-by keep. And also beginning waiting up till customers ring and also get products.